As of the latest reports available Berkshire Hathaway’s cash on hand, including cash equivalents, was $42.180 billion. However, more recent updates suggest a significant increase, with cash reserves reaching approximately $347.7 billion by the end of the first quarter of 2025, reflecting a record high amid strategic portfolio adjustments and market conditions. This figure includes cash and short-term investments, such as U.S. Treasury bills, which have been a growing component of their holdings. The variation in reported amounts may stem from different reporting periods and the inclusion of cash equivalents, so the $347.7 billion likely represents the most current estimate as of Q1 2025. Given the dynamic nature of their cash pile, this number could shift with their next financial disclosure.

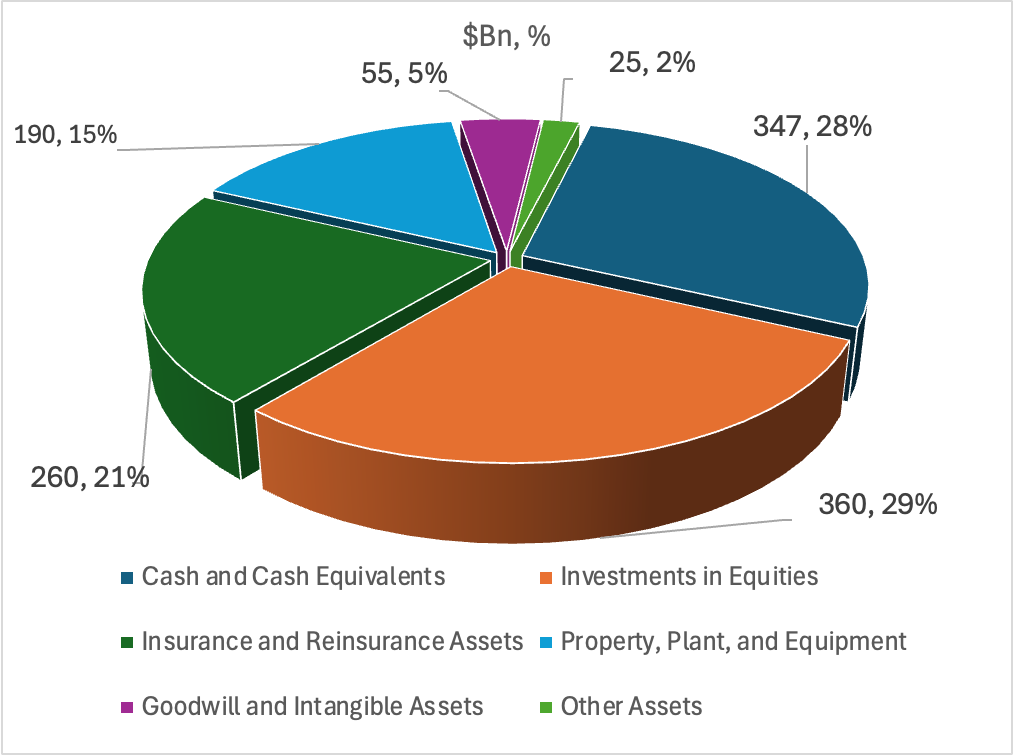

Breakdown of Berkshire Hathaway’s $1.2 Trillion Assets

Berkshire Hathaway’s asset portfolio is diverse, reflecting its conglomerate structure across insurance, railroads, energy, manufacturing, and investments. The following categories are derived from historical data and recent trends:

- Cash and Cash Equivalents: Approximately $347.7 billion (30% of total assets). This includes cash on hand and short-term U.S. Treasury bills, a significant increase from $328 billion in March 2025, driven by asset sales and reinvestments. This liquidity is a cornerstone of Buffett’s strategy.

- Investments in Equities: Around $350-370 billion (30-32%). This encompasses stakes in publicly traded companies like Apple ($170 billion market value as of Q1 2025), Bank of America, Coca-Cola, American Express, Chevron, and Occidental Petroleum. The exact figure fluctuates with market conditions and sales (e.g., $134 billion in U.S. stock sales in 2024).

- Insurance and Reinsurance Assets: Approximately $250-270 billion (21-23%). This includes premiums receivable, reserves for unpaid losses, and investments held by subsidiaries like GEICO and General Re, which form the backbone of Berkshire’s float—estimated at $164 billion in recent years.

- Property, Plant, and Equipment: About $180-200 billion (15-17%). This covers tangible assets like the BNSF Railroad network, Berkshire Hathaway Energy’s utilities, and manufacturing facilities (e.g., MiTek, Fruit of the Loom), reflecting its “real economy” focus.

- Goodwill and Intangible Assets: Around $50-60 billion (4-5%). Acquired through subsidiaries like Burlington Northern Santa Fe and Dur-O-Wal, these represent brand value and intellectual property, though their valuation can be subjective.

- Other Assets: Approximately $20-30 billion (2-3%). This includes receivables, inventories, and miscellaneous holdings, such as real estate and smaller investments not detailed in major categories.

Based on the finance card above, Berkshire Hathaway’s Class A (BRK.A) stock is currently priced at $728,200.00 USD, while Class B (BRK.B) is at $485.14 USD as of 03:08 PM PDT on June 19, 2025. For year-to-date performance, BRK.A started 2025 at $453.28 USD (per web data) and has risen to its current value, reflecting significant growth. Similarly, BRK.B began the year at a lower value (around $403.82 as the year low) and has climbed to $485.14, indicating a strong upward trend. This aligns with web sentiment noting a 17.3% gain through April 24, 2025, and posts on X suggesting a 16.1% to 19% increase year-to-date, outperforming the S&P 500’s decline. The stock’s resilience is attributed to its cash reserves and diversified holdings, though recent volatility and a high P/B ratio suggest caution

Implications for the Company

- Financial Flexibility: The $347 billion provides a robust buffer, enabling Berkshire to weather economic downturns, seize opportunistic acquisitions, or invest in undervalued assets. With a total asset base of $1.164532 trillion, this cash represents about 30% of its balance sheet, offering unmatched liquidity.

- Strategic Patience: CEO Warren Buffett’s decision to hold such a large cash reserve suggests caution, possibly anticipating a market correction or a major deal. It allows the company to act decisively when opportunities arise, as seen with past investments like BNSF Railroad.

- Dividend Policy: The cash hoard fuels speculation about a potential dividend, a departure from Buffett’s historical stance, which could signal a shift in capital allocation strategy to return value to shareholders.

Implications for Investors

- Stability and Confidence: For investors, this cash cushion enhances Berkshire’s resilience, reducing downside risk compared to peers with lower liquidity. It supports the stock’s 16.1%-19% year-to-date gain (BRK.A at $728,200, BRK.B at $485.14), outpacing the S&P 500’s decline.

- Growth Potential: The cash positions Berkshire to capitalize on undervalued stocks or acquisitions, potentially boosting long-term returns. However, its high price-to-book ratio (1.8x) suggests the stock may be pricey, tempering immediate upside.

- Dividend Hopes: Investors are buzzing on X about a possible dividend, which could enhance yield (currently negligible) and attract income-focused shareholders, though Buffett’s preference for reinvestment remains a wildcard.

- Opportunity Cost: Holding $347 billion in low-yield Treasuries (averaging 4-5%) versus deploying it in higher-return stocks or buybacks could frustrate growth-oriented investors, especially if market conditions stagnate.

The cash pile’s size—larger than the GDP of many nations—offers a safety net but also raises questions. It could indicate Buffett’s difficulty finding undervalued deals in an overvalued market, potentially signaling a bearish outlook. For investors, this balance of security and opportunity requires weighing short-term yield sacrifices against long-term strategic gains, making Berkshire a unique holding in 2025’s uncertain landscape.