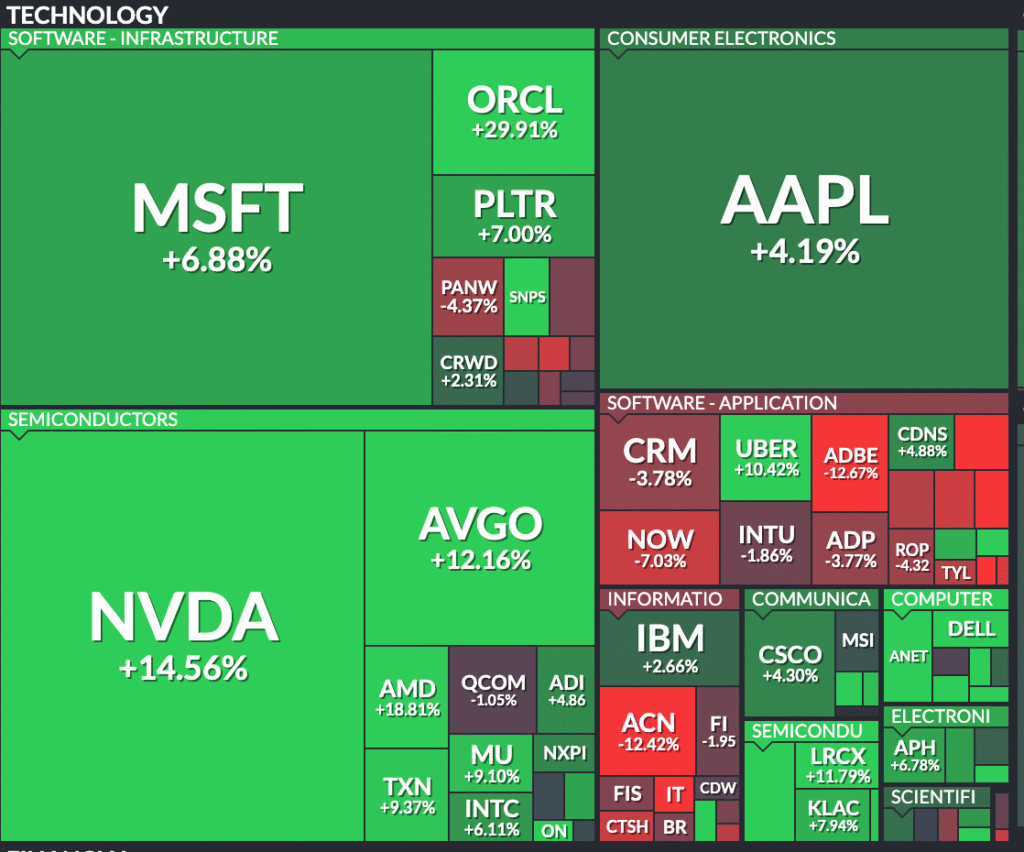

The technology sector delivered a strong performance over the past month, with several mega-cap names and semiconductor giants posting impressive gains. According to the latest Nasdaq data, tech stocks surged across key segments — led by explosive moves in AI, cloud infrastructure, and semiconductors.

Top Tech Gainers in June 2025

Nvidia (NVDA): +14.56%

Riding the ongoing AI wave, Nvidia continued its upward momentum with robust GPU demand and data center growth.

Oracle (ORCL): +29.91%

Oracle shocked the market with a nearly 30% gain, fueled by strong cloud earnings and AI-driven partnerships.

Advanced Micro Devices (AMD): +18.81%

AMD rallied after new chip releases targeting AI workloads, narrowing the performance gap with Nvidia.

Broadcom (AVGO): +12.16%

AVGO was another semiconductor standout, benefitting from strong demand in networking and AI chips.

Uber Technologies (UBER): +10.42%

UBER impressed investors with improved profitability and future guidance tied to mobility and logistics tech.

Micron Technology (MU): +9.10%

Micron surged on optimistic DRAM/NAND pricing and strong forward guidance.

Microsoft (MSFT): +6.88%

A steady performer, MSFT posted consistent growth, underpinned by Azure and its AI Copilot integration in Office.

Apple (AAPL): +4.19%

Apple rose modestly amid mixed signals in consumer electronics and iPhone sales outlook.

Top Tech Decliners in June 2025

Adobe (ADBE): -12.67%

ADBE fell sharply due to concerns about slowing subscription growth and rising competition in creative AI.

Accenture (ACN): -12.42%

The consulting giant reported weaker-than-expected revenue growth, especially in Europe.

ServiceNow (NOW): -7.03%

Despite long-term potential, NOW saw a short-term dip due to conservative enterprise spending.

Salesforce (CRM): -3.78%

CRM declined slightly, facing margin pressures and reduced cloud deal sizes.

Key Sector Trends This Month

Semiconductors ruled the charts, dominating the top gainers list with NVDA, AMD, AVGO, MU, and TXN all in strong green.

AI-driven momentum boosted companies like Palantir (+7%) and Oracle.

Software infrastructure outperformed application software, with Microsoft and Oracle leading while names like Adobe and Salesforce lagged.

Mixed signals in communications tech — Cisco (+4.30%) showed modest gains while others remained flat.

Consumer tech stable — Apple and Dell saw healthy but not spectacular growth.

The biggest takeaway from July 2025’s performance is clear: semiconductors and AI-aligned infrastructure companies dominated the month. If you’re tracking tech trends, it’s essential to follow this momentum closely heading into August.