In 2025, two of Wall Street’s most celebrated investors—Bill Ackman and Warren Buffett—demonstrate diverging paths to value creation. While Ackman leans into high-conviction, activist bets on transformational tech names, Buffett reinforces his long-standing focus on cash flow, balance-sheet strength, and global diversification. This deep dive unpacks their distinct approaches, highlights the sectors each favors, and offers actionable takeaways for investors seeking to adapt top-tier strategies to their own portfolios.

Bill Ackman’s 2025 Investment Style

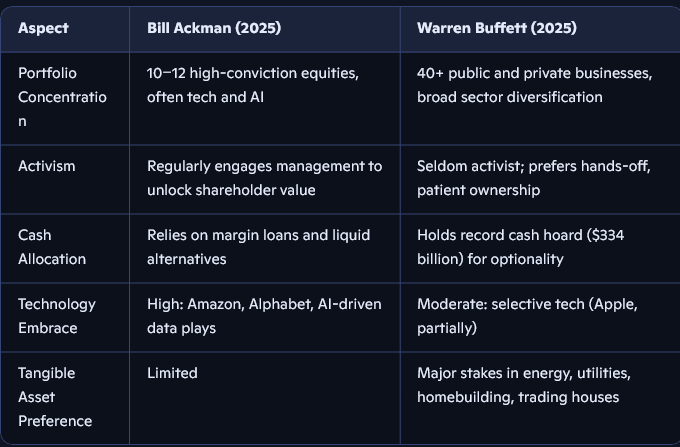

Bill Ackman’s Pershing Square Capital Management remains laser-focused on a handful of high-conviction positions. In Q2 2025, Ackman added roughly 5.82 million shares of Amazon—valued at $1.28 billion—and increased his stake in Alphabet by 20.8 percent, bringing Google to a $945 million holding. His portfolio comprises just ten core publicly traded stocks, each representing a meaningful percentage of assets. This concentration reflects Ackman’s belief that deeper research and activist engagement yield superior returns when he identifies structural dislocations.

Ackman’s emphasis on artificial intelligence underpins many recent moves. By mid-2025, roughly 45 percent of Pershing Square’s $13.7 billion equity book was invested in three AI-focused names, signaling his confidence in generative AI’s long-term profit potential. He hunts for business models where AI not only enhances products but also drives operating leverage—turning modest revenue growth into outsized earnings expansion. His willingness to deploy capital aggressively into digital-era juggernauts contrasts sharply with more traditional value approaches.

Warren Buffett’s 2025 Investment Style

Warren Buffett’s Berkshire Hathaway maintains a far more diversified stance, underpinned by a record cash hoard and a pipeline of steady, asset-intensive businesses. As of early 2025, Buffett held a historic $334.2 billion in cash and equivalents—up from prior years after nine consecutive quarters of net stock sales in 2024. This mountain of liquidity signals a cautious posture, ready to pounce on market dislocations and large strategic purchases rather than chase short-term momentum.

Buffett doubled down on energy and global diversification in 2025. He paid $3.9 billion to acquire the remaining 8 percent of Berkshire Hathaway Energy (BHE), valuing the utility at $49 billion—far below its 2022 estimate of $87 billion. Concurrently, Berkshire boosted stakes in five Japanese trading houses—Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo—bringing the total investment to $23.5 billion and generating $812 million in expected 2025 dividends. These moves underscore Buffett’s preference for regulated cash flows and dividend-rich, undervalued global conglomerates

Key Differences and What They Reveal

Bill Ackman’s approach exemplifies a modern hedge-fund playbook: narrow focus, activist engagement, and heavy weighting in secular growth themes such as AI and cloud. His concentrated Amazon and Google positions illustrate a willingness to accept higher volatility for outsized upside when technological change disrupts industries.

Conversely, Warren Buffett doubles down on his hallmark pillars: durable competitive moats, predictable cash flows, and value measured against intrinsic worth. By consolidating BHE ownership and expanding into Japanese trading firms, Buffett underscores his belief that regulatory-anchored utilities and diversified commodity networks deliver reliable returns, even in uncertain markets.

Lessons for Individual Investors

• Define Your Edge: Ackman thrives by combining deep sector expertise with activist tactics. If you favor concentrated bets, develop a research framework to engage or evaluate management quality before scaling into positions.

• Embrace Liquidity: Buffett’s massive cash reserve highlights the value of optionality. Maintain emergency cash or a low-yield equivalent to act decisively on large discounts or market panics.

• Prioritize Cash Flow: Both investors seek businesses with robust free cash flow. Whether you target AI-powered margin expansion or regulated utility yields, ensure your holdings generate ample liquidity to weather downturns.

• Balance Conviction and Diversification: Ackman’s tenacity in a handful of stocks offers lessons in focus, but also in risk. Buffett’s multi-sector portfolio shows how balance can reduce idiosyncratic shocks without entirely sacrificing growth opportunity.

Bill Ackman and Warren Buffett embody two ends of the value-investing spectrum in 2025. Ackman’s Big Tech blitz and activist zeal contrast with Buffett’s fortress balance sheet and global utility reign. Both styles yield outperformance when executed with discipline: Ackman by backing transformative AI leaders, Buffett by anchoring to proven cash‐generating assets. By blending these approaches—pairing strategic concentration with prudent liquidity and cash-flow analysis—individual investors can craft resilient portfolios equipped for the decade ahead.