In the ever-shifting landscape of financial markets, healthcare and insurance remain two of the most defensive sectors. As we head deeper into 2025, investors are weighing the merits of CVS Health stock against Chubb stock. Both tickers boast attractive valuations and clear growth catalysts, but which one deserves a spot in your portfolio? Let’s dive in.

Overview: CVS Health Stock

CVS Health (NYSE: CVS) has transformed from a pharmacy chain into an integrated healthcare powerhouse. Beyond dispensing prescriptions, CVS now offers primary care services through its MinuteClinic locations and is expanding into senior care via its acquisition of Oak Street Health.

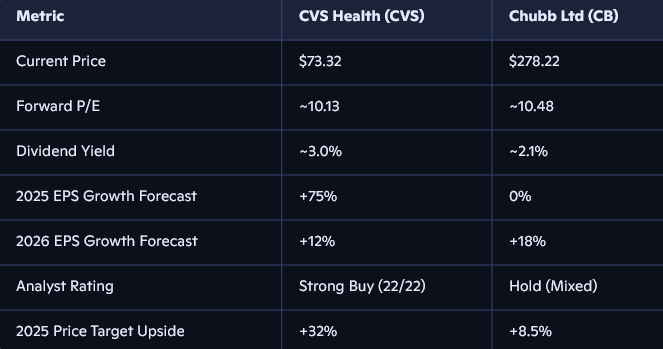

Trading around $73.32 with a forward P/E of ~10.13 and a dividend yield near 3%, CVS Health stock looks attractively valued compared to peers. Analysts forecast the share price to climb to $96.66 by December 2025, implying a potential upside of ~32%. That projection reflects strong earnings momentum, with EPS expected to grow 75% in 2025 and another 12% in 2026.

Key growth drivers for CVS Health include:

- Expansion of in-house healthcare services and clinics

- Synergies from recent acquisitions (e.g., Oak Street Health)

- Enhanced digital health offerings and telemedicine integration

- Cost efficiencies and supply chain optimizatio

Overview: Chubb Stock

Chubb Ltd (NYSE: CB) sits among the world’s largest publicly traded property and casualty insurers. With a reputation for underwriting discipline and conservative risk management, Chubb delivers steady profits and returns capital via dividends and share buybacks.

Currently trading near $278.22 and sporting a forward P/E of ~10.48 alongside a dividend yield of ~2.1%, Chubb stock appeals to income-oriented investors. The consensus 2025 price target of $302 suggests a more modest 8.5% upside. While EPS growth is projected to be flat in 2025, analysts expect an ~18% jump in 2026, driven by rate hikes in commercial lines and improved combined ratios.

Chubb’s core strengths include:

- Strong underwriting profitability and loss ratios

- Global diversification across 54 countries

- Disciplined capital management and high return on equity

- Exposure to specialty lines, including cyber and environmental insurance

Head-to-Head Comparison

Risk Factors to Consider

No investment is without its pitfalls. Here are the primary risks for each stock:

CVS Health risks:

- Regulatory scrutiny over drug pricing and pharmacy reimbursements

- Integration challenges post-acquisition, especially with Oak Street Health

- Margin pressure from rising labor and supply costs

- Potential slowdown in consumer healthcare spending

Chubb risks:

- Exposure to natural catastrophe losses (hurricanes, wildfires)

- Competitive pricing pressure in commercial insurance markets

- Interest rate fluctuations impacting investment income

- Currency and geopolitical risks in emerging markets

Valuation & Forecast: CVS vs Chubb

When valuing both companies, it’s clear that CVS Health stock offers higher upside potential based on current analyst targets and robust EPS growth projections. The double-digit forecasted EPS growth in healthcare services and the potential for margin expansion make CVS Health stock a compelling growth-at-value pick for 2025.

Chubb stock, however, shines for income investors seeking stability and steady dividends. Its conservative underwriting and proven capital return policies make Chubb stock one of the best insurance stocks 2025 for those prioritizing lower volatility.

Which Stock to Choose in 2025?

Ultimately, the choice between CVS vs Chubb depends on your investment goals and risk appetite:

- Choose CVS Health stock if you’re targeting higher upside and can tolerate integration risks and regulatory headwinds. The healthcare sector’s secular growth trends support a bullish stance on CVS.

- Choose Chubb stock if you prefer a lower-volatility play with reliable dividends and protection against market downturns. Chubb remains one of the best insurance stocks 2025 for conservative portfolios.

Conclusion

Both CVS Health and Chubb present attractive entry points in 2025, but they cater to different investor profiles. For aggressive growth and substantial upside, CVS Health stock holds the edge. For stable income and defensive positioning, Chubb stock stands out.

Before making any allocation, be sure to review your portfolio’s sector weights, risk tolerance, and long-term objectives. Whether you lean healthcare or insurance, both paths offer compelling reasons to deploy capital this year.