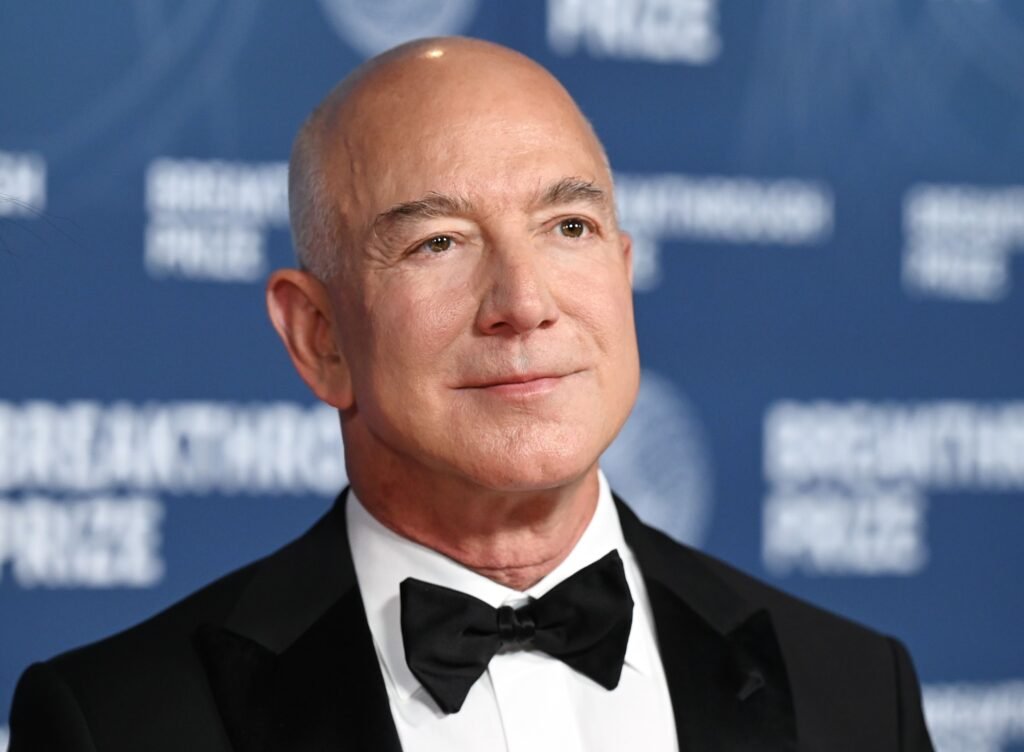

In early July 2025, a remarkable pattern emerged on U.S. stock markets: a surge in insider “sell” transactions across several major companies. From Amazon’s Executive Chair Jeff Bezos unloading over 2 million shares to Oracle’s Larry Ellison exercising 6 million options, these blockbuster trades have investors asking: “Is insider selling a red flag—or just routine portfolio management?”

Below, we unpack the top insider sales by dollar value, explore the potential motivations, and reveal what these moves could mean for savvy market participants

Why High-Profile Insiders Sell Shares

- Portfolio Diversification & Liquidity Needs

- Jeff Bezos’s sale of over $458 million in Amazon stock may reflect classic wealth diversification rather than bearish sentiment. Ultra-high-net-worth individuals frequently rebalance concentrated positions into alternative assets (real estate, private equity, etc.).

- Option Exercises & Tax Planning

- Larry Ellison’s exercise of 6 million Oracle options for $306 million suggests strategic tax-rate timing. Executives often exercise options after vesting periods to optimize capital gains treatment.

- Company-Specific Catalysts

- Snowflake’s Director Frank Slootman proposed selling 323,713 shares worth $72 million, possibly capitalizing on recent strength in cloud data warehousing. A portion of these sales could fund personal ventures or pre-scheduled trading plans (Rule 10b5-1).

Investor Takeaways: Signal or Noise?

- Not All Selling Equals Bearish Forecasts

Insiders often lock in gains after sustained rallies. For example, Amazon’s stock has climbed over 20% in 2025, making selective profit-taking a prudent move. - Watch for Chained Selling

Multiple insiders selling around the same dates—especially outside scheduled windows—can merit closer scrutiny. However, the July trades by Bezos, Ellison, and others all fell within typical open-window periods. - Context Matters

Compare insider sales against historical patterns: if a CEO is consistently reducing holdings over quarters, that may indicate confidence waning. But singular large trades often coincide with liquidity needs or estate planning.

Conclusion

While headlines about Jeff Bezos’s half‑billion‑dollar Amazon sale grab attention, most high-value insider transactions are part of normal wealth management strategies. By understanding the “why” behind these trades—diversification, tax planning, or predefined selling plans—investors can avoid knee‑jerk reactions and instead focus on fundamental and technical signals to guide their own portfolio decisions.