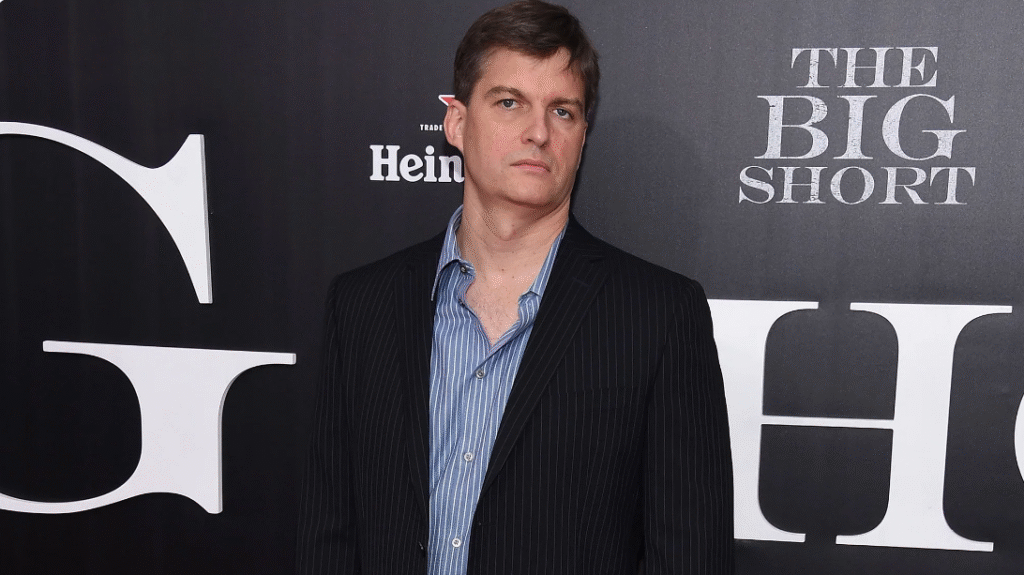

Michael Burry, the enigmatic investor immortalized in The Big Short, has once again stunned Wall Street—this time not by betting against it, but by going all in. In Q2 2025, Burry’s Scion Asset Management revealed a jaw-dropping $578 million portfolio, marking a dramatic pivot from his notoriously bearish stance just months earlier.

This isn’t just a portfolio update. It’s a strategic transformation that signals Burry’s renewed confidence in sectors many investors have either overlooked or abandoned. Let’s unpack the bold moves behind this seismic shift—and what they reveal about the man who thrives on swimming against the current.

From Bearish to Bullish: A Contrarian’s Reversal

In Q1 2025, Burry’s portfolio was a fortress of pessimism. He held massive put options against tech and Chinese stocks, including JD.com, and had slashed his long positions to near-zero. His total portfolio value hovered around $199 million, reflecting either cautious capital deployment or a deep conviction that the market was headed for a fall.

Fast forward to Q2, and the landscape looks entirely different. Burry eliminated all put positions and tripled his portfolio value to $578 million. This isn’t just a rebound—it’s a full-blown strategic overhaul.

Healthcare Takes Center Stage

At the heart of Burry’s bullish bets lies a surprising sector: healthcare. His top two holdings are call options on UnitedHealth Group and Regeneron Pharmaceuticals, together making up over 37% of his portfolio.

– UnitedHealth Group (UNH) – $109.2M (18.88%)

Burry’s largest position is a massive call option on America’s biggest health insurer. This marks a complete sector rotation from his Q1 avoidance of healthcare to making it his top conviction play. With diversified revenue streams and consistent dividend growth, UNH offers both stability and upside.

– Regeneron Pharmaceuticals (REGN) – $105M (18.16%)

Regeneron’s innovative drug pipeline and strong fundamentals make it a compelling bet. Burry’s sizable position suggests he sees long-term value in biotech, especially as the sector rebounds from post-pandemic volatility.

This healthcare-heavy allocation signals a belief in defensive growth—companies that can weather economic uncertainty while delivering innovation.

Betting on Lifestyle and Luxury

Burry’s contrarian streak shines through in his consumer picks. He’s placed significant call options on Lululemon Athletica and Estée Lauder—two brands that blend luxury with lifestyle.

– Lululemon (LULU) – $95M (16.43%)

A surprising entry into premium athleisure, this position suggests Burry sees continued consumer demand for high-margin fitness apparel. It’s a bet on discretionary spending resilience and brand loyalty.

– Estée Lauder (EL) – $40.4M (6.99%)

Burry doubled down on Estée Lauder, upgrading from common stock to call options and increasing his share count from 200,000 to 500,000. Despite recent headwinds in travel retail, he’s banking on the brand’s global dominance and long-term recovery.

These picks reflect a nuanced view of consumer behavior—one that anticipates a rebound in luxury spending even amid economic uncertainty.

Tech Redemption: Meta and JD.com

Perhaps the most striking reversal is Burry’s newfound embrace of tech. After aggressively shorting the sector in Q1, he’s now holding bullish positions in Meta Platforms and JD.com.

– Meta Platforms (META) – $73.8M (12.76%)

Burry’s call option on Meta marks a complete U-turn. He may be betting on the company’s AI investments, cost-cutting measures, and renewed focus on profitability. It’s a contrarian play on a tech giant many had written off.

– JD.com (JD) – $32.6M (5.64%)

In Q1, Burry held a bearish put position on JD.com. In Q2, he flipped to a bullish call and tripled his share count. This signals renewed confidence in Chinese e-commerce, possibly driven by improving macro conditions or undervaluation.

These moves suggest Burry isn’t just chasing momentum—he’s identifying mispriced assets in sectors that others have abandoned.

Bill Ackman’s Big Tech Blitz: Lessons from His Amazon and Alphabet AI Bets – Investor Vector

What It All Means

Burry’s Q2 2025 portfolio is more than a collection of stocks—it’s a masterclass in contrarian investing. By concentrating his bets in healthcare, luxury, and selectively in tech, he’s signaling a belief that the market has overcorrected in certain areas.

His portfolio turnover rate of 126.7% and average holding period of just one quarter reflect a high-conviction, high-velocity strategy. This isn’t passive investing—it’s tactical warfare.

Lessons for Investors

Michael Burry’s moves offer valuable insights for everyday investors:

– Don’t follow the herd: Burry’s success stems from identifying opportunities where others see risk.

– Conviction matters: His concentrated portfolio shows that deep research and bold positioning can outperform diversification.

– Adaptability is key: The shift from bearish to bullish in one quarter proves that even legendary investors evolve with the market.

From shorting the housing market to going long on health insurers and athleisure brands, Michael Burry continues to defy expectations. His $578 million bullish portfolio isn’t just a financial statement—it’s a philosophical one.

In a world obsessed with trends and consensus, Burry reminds us that the best opportunities often lie in the places no one’s looking. And when he moves, the market listens.