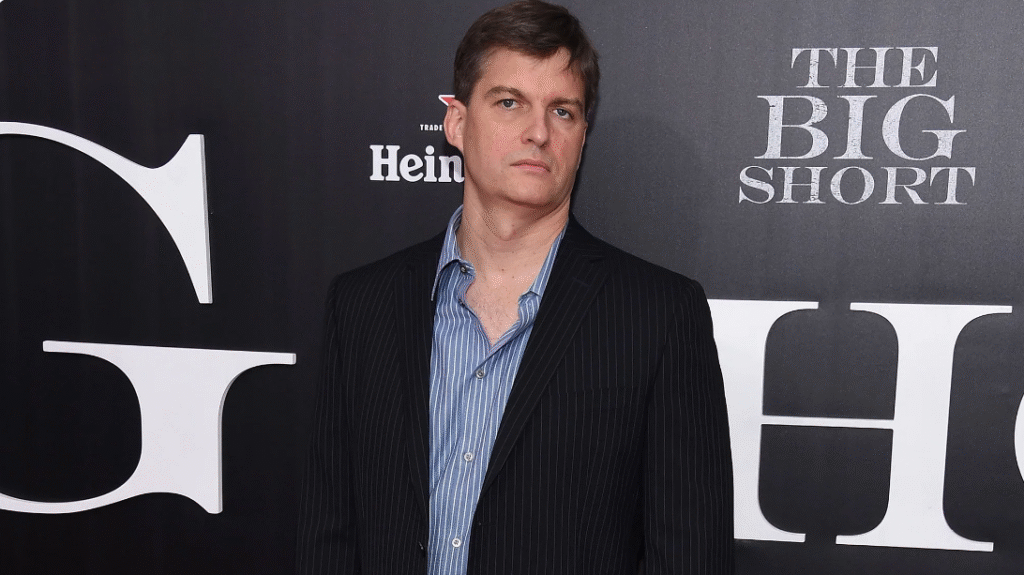

Unpack Michael Burry’s 2025 portfolio overhaul and learn how his switch from bearish put options to bullish calls reflects broader market sentiment. Discover contrarian investing lessons and Scion’s strategic sector bets.

1. A Seismic Shift in Scion’s Portfolio

After a bearish Q1 2025 stance—shorting tech and Chinese stocks—Michael Burry’s Scion Asset Management executed a dramatic reversal by Q2. Total notional value of bullish call options surged to $522 million, while prior put positions were liquidated entirely. This pivot highlights two key themes: renewed optimism in select sectors and the perils of one-way market bets.

2. Decoding the Contrarian Blueprint

- High Conviction, High Concentration: Burry concentrated over 60% of his portfolio into healthcare and consumer names, betting big on fewer, well-researched plays.

- Market Timing & Psychology: His ability to sense oversold conditions—first in Q1 tech, then healthcare in Q2—demonstrates an acute reading of market sentiment cycles.

- Flexible Risk Posture: Rapid turnover rate (over 100% per quarter) shows readiness to pivot when thesis changes.

This contrarian blueprint can help retail investors avoid herd traps and identify reversal points before the crowd jumps back in.

3. Sector Breakdown: Where Burry Sees Value

- Healthcare & Biotech: Call options on UnitedHealth and Regeneron now comprise ~37% of Scion’s holdings. Defensive growth amid rising medical costs makes healthcare a natural safe-haven.

- Luxury & Lifestyle: Burry’s Lululemon and Estée Lauder bets reflect confidence in discretionary spending resilience, even with macro uncertainty.

- Tech/AI Redemption: Flipping from bearish bets on Nvidia to bullish calls on Meta signals belief in AI’s long-term secular tailwinds.

Each sector pick ties back to Burry’s thesis: markets often overreact to near-term risks, creating windows of opportunity in fundamentally sound businesses.

4. What This Signals for Market Outlook

- Bullish Sentiment Rebound: Widespread put-to-call rotations suggest institutional players are transitioning back to risk-on mode.

- Selective Sector Strength: Healthcare and consumer discretionary may outperform in the second half of 2025.

- Volatility Ahead: Rapid portfolio swings underscore heightened uncertainty—traders should brace for sharp sector rotations.

As Burry’s moves often presage larger market shifts, his 2025 comeback may herald an inflection point in the global equity cycle.

5. Contrarian Investing Lessons

- Don’t Fear Volatility: Embrace market swings as chances to buy low and sell high on non-consensus ideas.

- Concentrate on Edge: Focus on a handful of high-conviction positions rather than broad diversification.

- Adapt Quickly: Be willing to cut losses on failed theses and redeploy capital into fresh opportunities.

By studying Scion’s quarter-over-quarter transformations, investors can refine their own playbooks for spotting mispriced assets.

6. Implementing Your Own Scion-Style Strategy

- Quarterly Review: Just as Burry updates every 13F, commit to a disciplined portfolio review schedule.

- Sentiment Indicators: Monitor put/call ratios, sector ETFs flows, and hedge fund conference pitches for early sentiment shifts.

- Option Leverage: Use call and put spreads to gain exposure with risk controls, emulating Scion’s asymmetric payoff approach.

- Thematic Research: Dive into macro themes—AI, healthcare innovation, premium consumer brands—to uncover overlooked winners.

A contrarian ethos doesn’t require radical moves; it demands rigorous research, patience, and the courage to oppose consensus when the data justifies it.

7. Final Thoughts

Michael Burry’s Q2 2025 pivot from a “Big Short” to a “Big Long” is more than headline-grabbing bravado—it’s a masterclass in timing, conviction, and risk management. By analyzing his sector bets and tactical option plays, investors can glean actionable insights to navigate an uncertain, yet opportunity-rich, market environment.

Embrace the contrarian mindset: when the crowd is fearful in one sector, be open to exploring another. That’s where the next wave of alpha is waiting.