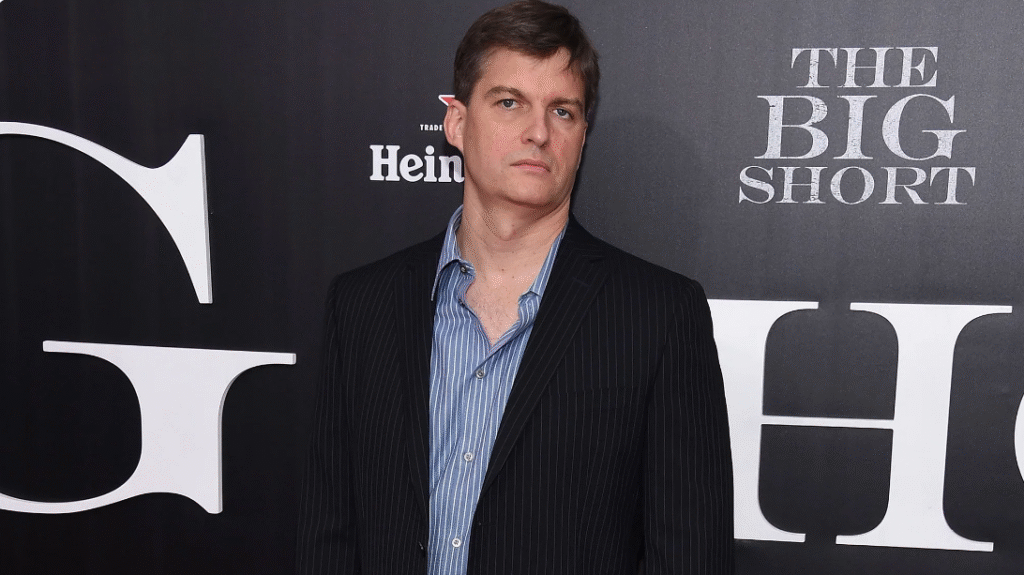

Discover why contrarian investor Michael Burry is loading up on Lululemon and Meta in Q2 2025. Explore athleisure market trends, AI growth strategies, and key insights from Scion Asset Management’s bullish call options.

1. Bold Contrarian Move in 2025

Michael Burry, famed for predicting the 2008 housing collapse, surprised the market by shifting from bearish puts to bullish call options on two very different names: Lululemon Athletica (LULU) and Meta Platforms (META). This strategic pivot in his Scion Asset Management portfolio signals conviction in athleisure growth and AI-driven advertising models.

In Q2 2025, Burry’s notional call option value on Lululemon and Meta topped $168 million, underscoring his confidence in these high-potential sectors.

2. Why Lululemon Athletica?

- Athleisure Market Trends 2025: The global athleisure market is projected to exceed $500 billion by year-end, driven by hybrid work lifestyles and health-focused consumers.

- Brand Loyalty & Pricing Power: Lululemon’s premium margin and community-centered retail strategy create sustainable competitive moats.

- Valuation Edge: Trading at just 14× forward earnings, LULU appears undervalued compared to historical averages, making it ripe for a rebound.

Burry’s $95 million call option on Lululemon bets on both international expansion—especially in Asia—and robust same-store sales recovery. His analysis likely hinges on resilient consumer spending and new product innovations such as performance-wear collaborations.

3. The Meta AI Renaissance

- AI Growth Strategy: Meta’s pivot to generative AI and personalized ad targeting is reshaping digital marketing.

- Revenue & User Base: With over 3.7 billion daily active users, Meta generates $32 billion in annual free cash flow—fuel for AI research and share buybacks.

- Contrarian Valuation: After a steep sell-off in 2024, META trades at roughly 20× forward earnings, making it attractive for value-focused, contrarian investors.

Burry’s $74 million call position on Meta reflects his thesis that AI-powered ad monetization and cost-cutting initiatives will drive next-phase growth. This aligns with broader market optimism about Big Tech’s AI leadership.

4. Scion’s Call Option Strategy Explained

Call options allow investors to control large share counts with relatively small capital outlays. For Burry:

- Leverage Without Leverage: He gains exposure to upside potential without borrowing large sums.

- Asymmetric Payoff: If LULU or META rallies, the return multiples on premium paid can exceed those of outright stock purchases.

- Risk Capping: Maximum loss is limited to option premium, crucial for volatile sectors.

This tactical approach reflects Scion’s high-conviction, short-term holding period—averaging just one quarter per position in 2025.

5. Key Takeaways for Investors

- Spot Undervalued Leaders: Look beyond index favorites; Lululemon and Meta may offer outsized potential.

- Harness Emerging Trends: Athleisure demand and AI-driven ad growth remain structural trends.

- Use Options Judiciously: Call options can magnify returns with defined risk if you understand expiration dates and strike prices.

By mirroring some of Burry’s contrarian logic—targeting sectors with long-term structural tailwinds—you can create a more dynamic, opportunity-driven portfolio.

6. Action Plan: Next Steps

- Deep Dive Research: Read Scion Asset Management’s latest 13F filing to understand position sizing and expiry months.

- Keyword Monitoring: Track athleisure market data, Meta AI updates, and social sentiment for early signals.

- Pilot Options Trade: Test a small call option play on LULU or META with a conservative budget.

- Portfolio Review: Ensure any new positions align with your risk profile and investment horizon.