For years, Lululemon has been more than just a brand; it’s been a lifestyle. A symbol of aspirational wellness, sleek design, and an almost cult-like following. Owning a pair of their buttery-soft leggings wasn’t just about comfort; it was a statement. Investors loved them, too, watching the stock soar to dizzying heights, seemingly immune to the fickle winds of retail.

But today, the illusion shattered. Lululemon’s stock plummeted a staggering over 18%, wiping out billions in market value faster than you can say “Align Pant.” For many, it felt like an earthquake in the seemingly unshakeable world of athleisure. The question on everyone’s mind: What the heck just happened?

This isn’t just about stock charts; it’s about what happens when a beloved brand hits a wall. And the implications go far beyond Wall Street.

The Cracks in the Athleisure Kingdom: More Than Just a Bad Day

Lululemon’s colossal drop wasn’t a random blip. It was the culmination of several alarming trends that hit harder than a burpee workout after a long day. Let’s break down the major culprits:

1. The American Dream Turned Sour: Weak U.S. Sales The most immediate shockwave came from Lululemon itself. The company reported weaker-than-expected sales in its crucial U.S. market and, as a direct consequence, slashed its full-year revenue and profit forecasts. For a brand that has consistently delivered strong growth, especially domestically, this was a massive red flag. Investors thrive on growth, and when the engine sputters in the most important territory, panic sets in.

2. The Tariff Tornado: A Looming Profit Problem Remember those pesky things called tariffs? Lululemon certainly does. The company explicitly cited higher tariffs and the removal of the “de minimis” exemption as a significant headwind. For context, this exemption previously allowed many low-value packages (under $800) to enter the U.S. duty-free. As a company that manufactures a substantial portion of its products in Asia, this policy change isn’t just a nuisance; it’s a direct hit to their profit margins. Think about it: higher import costs mean less profit per pair of leggings unless they drastically raise prices (which comes with its own risks).

3. “Too Predictable”: The Innovation Stagnation Perhaps the most telling confession came from Lululemon’s CEO, who admitted that some of their casual styles had become “too predictable.” Ouch. In the fast-paced world of fashion and athleisure, predictability is the kiss of death. Consumers, especially the highly trend-conscious Lululemon demographic, crave freshness, innovation, and novelty. If the brand isn’t evolving, competitors will swoop in. This raises a critical question: Has Lululemon lost its creative edge? Can they truly reignite consumer interest quickly enough, or will this “turnaround” be a long, arduous process?

4. The Broader Economic Chill: A Rising Tide Lifts All… or Sinks All While Lululemon’s issues are largely self-inflicted, they didn’t occur in a vacuum. The broader market experienced a downturn on the same day, fueled by a soft jobs report that sparked wider concerns about the health of the U.S. economy. When the economy is shaky, consumers tend to pull back on discretionary spending – think premium activewear. This macroeconomic headwind simply amplified Lululemon’s individual woes.

Lululemon Sues Costco Over Alleged Knockoff Apparel – Investor Vector

Wall Street’s Verdict: The Downgrade Deluge

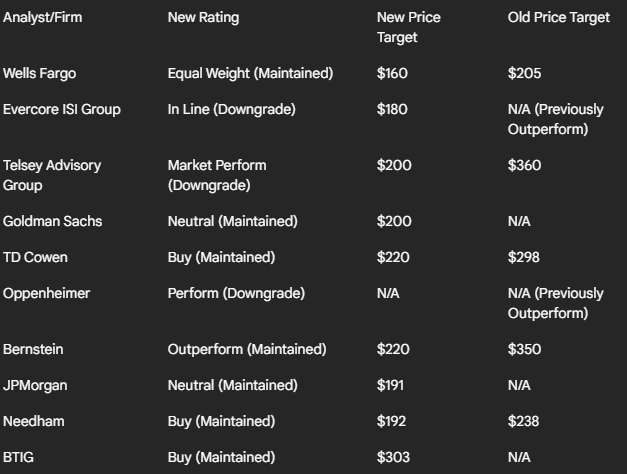

When a company stumbles this badly, analysts on Wall Street react swiftly. The downgrades came fast and furious, acting like gasoline on an already burning fire. Here’s a snapshot of how some major players revised their outlook:

The message is clear: the rosy picture of Lululemon’s endless growth has been replaced with a much more cautious, if not outright pessimistic, outlook. Price targets were slashed by significant margins, reflecting a belief that the road ahead will be tough.

What This Means For YOU: Shopper, Investor, and Athleisure Enthusiast

If you’re an investor: This is a stark reminder that even seemingly invincible brands can falter. The long-term trajectory of Lululemon will depend heavily on its ability to innovate, manage costs (especially tariffs), and reignite enthusiasm in its core market. It’s a moment for caution and careful evaluation, not blind faith.

If you’re a shopper: Don’t expect immediate fire sales, but this downturn could signal a shift. If Lululemon struggles to move inventory or faces increased competition from brands offering similar quality at lower price points, we might eventually see more aggressive promotions or a renewed focus on value. More importantly, it highlights the importance of asking: Am I paying for quality, or just the brand name and the perception of exclusivity?

For the athleisure industry as a whole: This is a wake-up call. The explosive growth of the past decade is maturing. Brands need to innovate, differentiate, and offer compelling value to survive and thrive. The “predictable” path is no longer a viable option.

The Bottom Line: Is the Lululemon Dream Over?

Not necessarily. Lululemon still has a powerful brand, a loyal customer base, and a strong global presence. However, this is undoubtedly a pivotal moment. The company needs to pivot, innovate, and address its structural challenges head-on.

The Lululemon illusion of effortless, endless growth has been broken. Now, the real work begins. And for consumers and investors alike, it’s a powerful reminder that even the most celebrated brands can stumble when they lose touch with their market or fail to adapt to a changing world.