Tired of sky-high mortgage rates and the endless landlord headaches? You’re not alone. With the average 30-year fixed mortgage hovering near 7%, traditional homeownership feels out of reach for many retail investors. Enter Real Estate Investment Trusts (REITs): publicly traded companies that own, operate, or finance income-producing properties. Congress created REITs in 1960 to democratize real estate, and today they allow anyone with a brokerage account to gain exposure to apartments, office towers, warehouses, and more—all without the need for down payments, maintenance calls, or eviction notices.

In this post, we’ll unpack why REITs are reshaping real estate investing, explore specialty REITs riding megatrends like data centers and healthcare facilities, and reveal how hefty dividends can supercharge your passive-income goals. Whether you crave steady cash flow or sector-specific growth, REITs might just be the rental property of the 21st century. Ready to revolutionize your portfolio? Let’s dive in.

REITs 101: Your Shortcut to Real Estate Ownership

A REIT (pronounced “reet”) is a company that owns or finances real estate that produces income. By law, REITs must distribute at least 90% of their taxable income to shareholders, making them dividend powerhouses. There are three primary REIT categories:

- Equity REITs

• Own and manage physical properties—apartments, shopping malls, warehouses, and more.

• Generate income from rent and property sales. - Mortgage REITs (mREITs)

• Invest in mortgages or mortgage-backed securities.

• Earn from interest spreads between short-term borrowing and long-term lending. - Hybrid REITs

• Combine equity and mortgage strategies.

• Balance rental income with financing returns.

Equity REITs further split by asset class—residential, office, industrial, retail, healthcare, and hospitality—so you can pick the slice of real estate you believe will outperform. Because REIT shares trade on major exchanges like stocks, they offer liquidity and ease that direct property investing simply can’t match

Beyond the Traditional: Niche REITs Tapping High-Growth Sectors

While apartment and office REITs dominate headlines, alternative or “specialty” REITs are where the growth stories often live. These niche trusts focus on property types tied to powerful secular trends, including:

• Data Center REITs

– Own facilities that power cloud computing and AI workloads.

– Benefit from explosive data usage—Digital Realty (DLR) and Equinix (EQIX) are market leaders with long-term tenant contracts and recurring revenue streams.

• Healthcare REITs

– Invest in senior housing, medical office buildings, and hospitals.

– Aging populations worldwide are driving demand. Companies like Welltower (WELL) and Medical Properties Trust (MPW) command high occupancy and durable leases.

• Self-Storage REITs

– Offer space for household and business storage.

– Supply constraints in urban markets support brands like Public Storage (PSA) and Extra Space Storage (EXR) with occupancy rates above 90%.

• Infrastructure REITs

– Include cell towers (e.g., American Tower, AMT) and fiber-optic networks.

– 5G rollouts and data consumption fuel these emerging real-asset plays.

These specialty REITs trade like tech stocks—with growth multiples reflecting their unique revenue drivers—yet still deliver the stability of long-term leases and inflation-linked rent escalators.

Dividend Potential: Passive Income Meets Liquidity

One of the most compelling reasons to own REITs is their dividend yield. By law, REITs must distribute 90% of taxable income, translating into attractive payouts that often exceed the S&P 500 dividend yield by a wide margin.

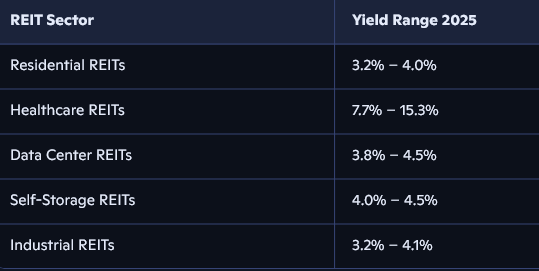

Here’s a snapshot of sector yields (2025 data):

High yields aren’t the whole story. Look for a balanced payout ratio—ideally below 80%—to ensure dividends are sustainable during market stress. Mortgage REITs, with higher yields (often 8%+), can amplify income but come with interest-rate sensitivity and leverage risks. Equity REITs in growing property niches strike a sweet spot: double-digit dividend growth potential plus capital appreciation as property values rise.

Getting Started: Building Your REIT Portfolio

- Define Your Goals

• Income Focus: Lean into high-yield sectors like healthcare or mortgage REITs.

• Growth + Income: Combine data center and industrial REITs for secular tailwinds. - Diversify Across Sectors

• Avoid concentration in one property type. A mix of residential, industrial, and specialty REITs smooths volatility. - Use ETFs for Instant Diversification

• Vanguard Real Estate ETF (VNQ) for broad exposure.

• iShares U.S. Real Estate ETF (IYR) for large-cap REITs.

• SPDR S&P Regional Banking ETF (KRE) for a mix of regional mREITs. - Monitor Interest Rates

• Rising rates can pressure mREITs; equity REITs tied to strong property fundamentals tend to weather rate hikes better.

By treating REITs like dividend stocks, you gain transparency, liquidity, and sector-specific leverage—without the landlord drama.

With homeownership costs soaring and rental markets tightening, REITs are emerging as the modern alternative to buying rental property. They deliver high yields, sector-targeted growth, and the simplicity of stock investing. Whether you’re chasing passive income or riding niche real-asset trends, REITs deserve a prime spot in your portfolio.