When it comes to tapping into China’s high-growth tech sector, few options offer the compelling blend of innovation and value that American Depository Receipts (ADRs) provide. In today’s volatile market environment and amid evolving trade negotiations, savvy investors are increasingly turning to Chinese mega tech companies listed in the U.S. These stocks not only provide a direct avenue into China’s blossoming technology and consumer sectors but also shield you from excessive currency fluctuation risks.

Forget About Starting From Scratch

Recent economic data shows Chinese retail sales surged in May 2025, even as industrial output reached a six-month low. While this mixed bag of indicators reflects a cautious economic landscape, green shoots and pockets of robust consumer demand are emerging across various industry sectors. Combined with steady trade negotiations that bolster market confidence, these trends underscore the resilience and untapped potential of China’s tech giants. For a prudent investor, buying these names at valuations below their historical average price-to-earnings (PE) ratio presents an exceptional opportunity to capture long-term growth when the market undervalues these firms.

Moreover, investing in these ADRs lets you bypass the risks associated with direct foreign exchange exposure. You gain access to the dynamism behind Tencent, Alibaba, Baidu, JD.com, and BYD—which are all trading at attractive multiples—and position your portfolio to benefit from an upbeat trade landscape and a burgeoning digital economy.

Company Spotlights: Why Each Tech Giant Shines

The following sections present a snapshot for each company, highlighting their core strengths and why they deserve a place in your portfolio.

- Tencent: Tencent stands as a digital ecosystem behemoth, combining unparalleled leadership in social media, gaming, and fintech. The company continuously delivers innovation in entertainment and online services, fueling robust growth. Its diverse revenue streams and strategic investments in AI and cloud computing further solidify its position as a perennial tech powerhouse.

- Alibaba: Alibaba redefines e-commerce and cloud services for a massive, interconnected marketplace. With its innovative digital payment systems and logistics network, the company consistently expands market share in a rapidly evolving digital economy. Its expansive ecosystem and forward-thinking strategies make it an attractive prospect for investors seeking both growth and robust market penetration.

- Baidu: Baidu sits at the forefront of China’s artificial intelligence revolution. As the country’s leading search engine and digital innovator, Baidu is investing heavily in autonomous driving, AI cloud services, and smart apps. Its relentless pursuit of technological advancement positions it as a critical player in the next generation of digital transformation.

- JD.com: JD.com leads with a customer-centric approach that revolutionizes online retail and logistical efficiency. By blending high-quality delivery networks with advanced technology, the company delivers exceptional consumer experiences. Its relentless focus on speed, reliability, and innovation has helped secure a dominant market position in China’s rapidly growing e-commerce space

- BYD: BYD is a dynamic force in electric vehicles and renewable energy. With cutting-edge battery technology and robust manufacturing capabilities, BYD is well-positioned to capitalize on the global push toward sustainable transportation. Its aggressive expansion and strategic partnerships indicate significant potential for aligning environmental goals with impressive market returns

Economic Backdrop: Data and Trends That Affirm the Opportunity

Yesterday’s economic snapshot reveals a notable uptick in monthly Chinese retail sales, indicating rising consumer confidence and spending. In contrast, industrial output hit a six-month low. Despite these divergent trends, resilience is evident. The strong retail sales performance suggests that consumers are bouncing back, even if industrial activity remains subdued temporarily.

Trade negotiations have also played their part in uplifting Chinese market sentiment. Recent discussions have provided relief in some key export areas, offering a breather to companies that have been burdened by uncertainties. These factors dovetail neatly with the undervalued trading levels of Chinese tech ADRs today.

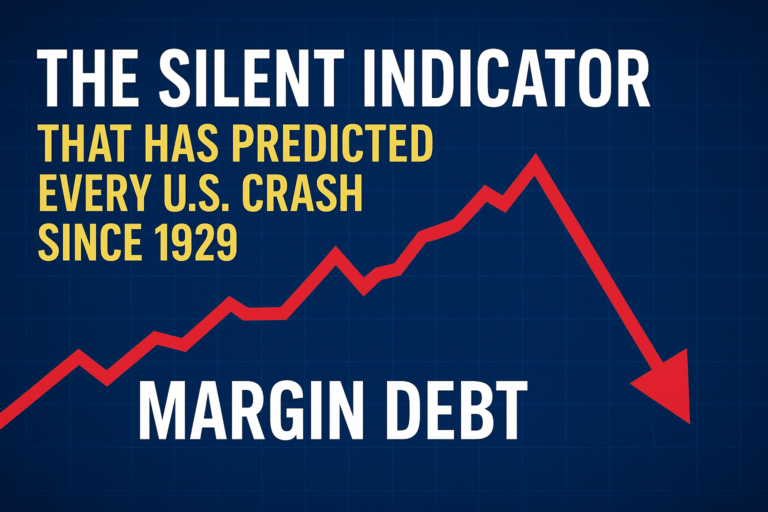

Investors looking at these stocks should consider that the current low valuations—often trading below historical average PE ratios—create a window of opportunity to buy quality names at a discount. This approach is particularly appealing when the long-term fundamentals of these companies remain intact and the underlying tech and consumer trends continue to unfold favorably.

Navigating Market Uncertainty with a Methodical Approach

An advantage of investing in ADRs is the alignment of strong fundamentals with a disciplined valuation strategy. Buying these dynamic Chinese tech companies only when they trade near historically attractive PE ratios allows investors to avoid overpaying. This strategy is especially compelling during periods of market uncertainty when sector valuations temporarily dip, paving the way for robust, long-term gains.

Moreover, given that these companies are key players in industries—from artificial intelligence and autonomous technology to e-commerce and renewable energy—they remain at the forefront of global innovation. Their solid market positions and persistent investments in future technologies make them not only resilient in the face of macroeconomic challenges but also ideal candidates for a robust, diversified portfolio.

Seize the Opportunity to Invest in Global Innovation

In summary, Chinese mega tech ADRs represent a smart, pragmatic way to tap into the evolving Chinese economy without shouldering the full burden of currency volatility. With an environment punctuated by mixed economic signals—rising retail sales, subdued industrial output, yet resilient consumer behavior—and the continual evolution of trade policies, now is the time to seize quality investments at historically attractive valuations.

For investors who are willing to adopt a forward-thinking, disciplined approach, the opportunity to capture long-term growth with these undervalued stocks is simply too tantalizing to ignore. Embrace the dynamism of Tencent, Alibaba, Baidu, JD.com, and BYD. By focusing on these technology leaders, you’re not just investing in a company—you’re investing in the future of innovation that bridges East and West.

The pulse of China’s technological resurgence beats strong beneath the surface of market volatility. As green shoots of recovery become visible across sectors, the opportunity to build an enduring and growth-oriented portfolio becomes the call of the moment. So, if you’re ready to ride the wave of global innovation and secure your stake in tomorrow’s tech landscape, these ADRs are your beckoning gateway to worldwide prosperity.

Invest smartly, invest patiently, and let the transformative energy of Chinese tech propel your portfolio into a future of unbridled growth.